Table of Contents

Understanding Residency by Investment

Globetrotters and savvy investors alike are often on the lookout for opportunities that open up new horizons. Residency by investment is one such pathway that has garnered significant attention. It’s not simply about acquiring a new domicile; it’s about expanding one’s lifestyle and business prospects to the global stage.

The concept is straightforward: invest a specified sum in a country’s economy, and in return, gain the right to reside there — and often, enjoy the benefits that come with it, such as access to healthcare, education, and visa-free travel to various destinations. But beyond these benefits, residency by investment can serve as a strategic move for asset diversification and fiscal planning.

At Apex Capital Partners, we have seen firsthand how these programs can transform lives. Not only do clients attain enhanced global mobility, but they also reap the long-term benefits of economic stability and growth in diverse markets.

Selecting the Ideal Residency by Investment Program

The decision to pursue residency by investment must be accompanied by diligent research and expert guidance. With myriad options available, each with its unique investment thresholds and benefits, the task can seem daunting. In our practice, we emphasize the importance of aligning a program with a client’s personal and financial goals.

Some programs, like Portugal’s Golden Visa, have gained popularity for their straightforward application process and potential for EU citizenship down the line. Others, such as the United States’ EB-5 Investor Program, provide a pathway to one of the world’s leading economies, albeit with a heftier investment requirement.

Our role in this is crucial; we sift through the details, analyzing factors like tax implications, residency requirements, and family inclusivity, ensuring that the program you choose fits like a glove.

Investment Routes and Due Diligence

Investment is not a one-size-fits-all affair. Some jurisdictions offer residency in exchange for property investments, while others require contributions to national development funds or local businesses. For instance, an investment in Malta’s real estate can secure a spot in the sun-soaked Mediterranean, while a financial stake in a burgeoning business in New Zealand could provide access to a life down under.

To navigate through these choices, due diligence is key. Our team conducts comprehensive analyses to ascertain the credibility and potential of each investment option. We do this not only to meet regulatory standards but also to safeguard our clients’ interests and ensure that their investments yield promising returns.

Through our wheelhouse of experience, we’ve observed that clients not only seek residency but also a place they can call a second home. This sentiment is central to our advisory process, ensuring the investment made resonates with their aspirations.

Navigating the Application Process

The journey to residency by investment involves meticulous paperwork and legal navigation. Clients are often surprised by the level of detail required, from background checks to financial disclosures. This is where our team becomes an invaluable asset.

We streamline the process, handling the complexities so that our clients can focus on the bigger picture. Our established relationships with local authorities mean that we can efficiently follow up on applications, preemptively addressing any potential hiccups.

Beyond the initial application, we keep our clients informed at every stage, translating legal jargon into clear terms and providing regular updates. Our approach is personable yet professional, ensuring a seamless transition to their new residency status.

In instances where the process seems strenuous, we remind our clients of the end goal: a life enriched with global opportunities and the security of a second home. Our team’s dedication to this vision has turned many a bureaucratic challenge into a success story.

Real Estate Investment: A Popular Choice

Among the various investment options, real estate remains a popular choice for those pursuing residency by investment. It’s tangible, often comes with potential rental income, and in some cases, appreciates in value over time.

In countries like Greece, where the minimum investment is relatively affordable, a quaint villa can pave the way to residency. This option is particularly attractive to clients who envision a vacation home that doubles as a strategic investment.

At Apex Capital Partners, we have a keen eye for properties that not only meet the legal thresholds but also stand out as wise investments. Our understanding of local markets guides our clients towards choices that offer both lifestyle and economic benefits.

Residency by Investment: The Bigger Picture

Residency by investment is not merely a transaction; it’s a life-changing decision with far-reaching implications. For the discerning individual, it represents a gateway to global mobility, an insurance policy in an uncertain world, and a legacy to pass down to future generations.

We’ve seen clients leverage their new status to expand their businesses into international markets, secure educational opportunities for their children, and diversify their investments. The thread that connects all these stories is the aspiration for a world without boundaries.

As pioneers in this realm, we at Apex Capital Partners are poised to open doors to new beginnings. Our expertise transcends the transactional aspects, touching upon the personal narratives that each residency by investment brings to life.

Tax Considerations and Residency

One of the most crucial aspects of residency by investment is navigating the tax implications. While some seek the haven of low-tax jurisdictions, others prefer the stability offered by nations with more comprehensive tax systems.

Our advisory extends to these fiscal landscapes, ensuring clients are aware of their tax obligations and can make informed decisions. A new residency can offer favorable tax treatment of foreign income or assets, which, when managed correctly, can result in significant savings.

Of course, tax considerations are just one piece of the residency by investment puzzle, but it’s a piece that can influence the overall picture significantly. With Apex Capital Partners’ guidance, clients can find harmony between their new residency and their financial health.

A Chapter from Our Book of Experiences

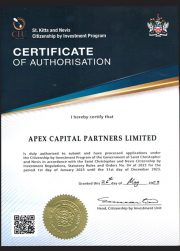

Let me share an anecdote that exemplifies the transformational impact of residency by investment. One of our clients, a tech entrepreneur, sought to expand her business while securing a plan B for her family. After evaluating various options, we settled on the Caribbean island of St. Kitts and Nevis, known for its business-friendly climate and expedited route to residency.

What started as a strategic move blossomed into a love affair with the island’s culture and community. Our client’s investment in a local tech hub not only secured her family’s residency but also contributed to the island’s burgeoning tech scene.

This story is a testament to the holistic approach we take at Apex Capital Partners — where residency by investment is not just about the investment itself, but about how it intertwines with one’s personal narrative and aspirations.

Partnering with Apex Capital Partners

Choosing to embark on a residency by investment journey is a vote of confidence in one’s future, and at Apex Capital Partners, we honor that decision with our unwavering support and expertise. Our tailored strategies, combined with a deep understanding of global markets, pave the way for sound investments and a fulfilling lifestyle.

From handling documentation to providing insights into local cultures, our comprehensive service ensures that the transition into a new residency is not just successful but also enriching. As your partners, we’re not just advisors; we’re architects of the future you envision.

For those contemplating residency by investment, we extend an invitation to explore the possibilities with Apex Capital Partners. Together, we’ll turn aspirations into realities, building bridges to a world of opportunities.

What is residency by investment?

As a concept that intertwines fiscal strategy with global mobility, residency by investment is an avenue for investors to broaden their life and business prospects by making a significant financial contribution to a country’s economy. In return, investors are granted the right to reside within that country. This right often extends to their families and includes benefits such as access to healthcare, education, and a potential pathway to citizenship. Our role at Apex Capital Partners is to tailor this journey, ensuring it aligns perfectly with our clients’ long-term aspirations and lifestyle preferences.

Is citizenship by investment worth it?

Undoubtedly, citizenship by investment can be a game-changer for many of our clients. It opens doors to new opportunities and provides a sense of security in today’s ever-changing global landscape. The value goes beyond the immediacy of accessible travel or lifestyle changes; it extends to the realms of business growth, tax planning, and legacy building. One must consider the broader implications, such as the enhancement of one’s global footprint and the potential for generational benefits. Each investor’s situation is unique, and that is why at Apex Capital Partners, we delve deeply into each client’s goals to ascertain the true worth of citizenship by investment for their future.

Can I get a green card if I invest in real estate?

In the United States, the EB-5 Investor Program does indeed offer a pathway to a green card through investment, which can include real estate investment. However, simply purchasing property is not sufficient; the investment must fulfill certain criteria, such as job creation, and meet the required investment amounts. It’s a complex process that requires meticulous planning and understanding of the regulations, but for many of our clients, this route has been their pathway to a green card and a future in the United States.

Do EB-5 investors get their money back?

With the EB-5 program, return of capital is possible, but it’s not guaranteed and should not be the primary motivation for the investment. The nature of the investment must be at-risk, according to USCIS regulations, meaning the capital must be subject to gain or loss. Our clients have found that while the possibility of a financial return does exist, the more significant return on investment comes from the benefits of U.S. residency. When we consult with our clients, we help them understand the financial contours of the EB-5 program and set realistic expectations.

How secure is residency by investment?

Security in residency by investment depends heavily on the due diligence performed beforehand. At Apex Capital Partners, we conduct exhaustive checks to ensure the programs we recommend are credible and stable. Moreover, many countries with such programs have a vested interest in maintaining their integrity and appeal. It generally leads to alignment between the investor’s security and the host country’s commitment to the program’s success. Nevertheless, we always remind our clients that political and economic climates can change, and so we monitor such situations closely to navigate any potential risks.

How can residency by investment contribute to my business’s strategic growth?

Residency by investment can act as a catalyst for business expansion by offering access to new markets and international networks. It provides a base from which to explore cross-border trade opportunities, attract global talent, and benefit from different economic zones. One of our clients, for example, used her new residency status to establish a European base for her tech firm, leveraging local talent and expanding her company’s reach. We help our investors strategize such moves, ensuring their investment does more than secure residency–it propels their business forward.

Residency by Investment Resources

-

United States Citizenship and Immigration Services (USCIS) – EB-5 Immigrant Investor Program: This page provides information about the U.S. EB-5 program, including eligibility, processes, and regulations.

https://www.uscis.gov/eb-5 -

Portugal’s Official Immigration Website – Golden Visa: The official resource for detailed information on the Portugal Golden Visa program, requirements, and benefits.

https://imigrante.sef.pt/en/ -

New Zealand Immigration – Investor Visas: New Zealand’s official immigration website outlining the options and requirements for investor visas.

https://www.immigration.govt.nz/new-zealand-visas/options/invest -

Internal Revenue Service (IRS) – Taxation of Nonresident Aliens: This IRS page provides information about tax obligations for nonresident aliens in the U.S., which can be useful when considering the EB-5 program.

https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens -

Greek Immigration Policy – Residency Permits for Real Estate Owners: The official Hellenic Republic website on immigration policies for those interested in obtaining residency through real estate investment in Greece.

https://www.migration.gov.gr/en/guide/residence-permit-for-real-estate-owners/ -

Government of Malta – Residence Programmes: Official site of the Government of Malta providing information on the various residency by investment programs they offer.

https://residency.maltaenterprise.com/ -

St. Kitts and Nevis Citizenship by Investment Unit: Official website for the St. Kitts and Nevis Citizenship by Investment program, providing guidelines and application details.

https://www.ciu.gov.kn/