Now more then ever crypto investors are in the focus of attention for the governments and politicians, banks, real estate agencies and CIP experts. Because this type of people tends to do everything its own way. And crypto investors want to obtain second citizenships just for that. Investment migration programs complement cryptocurrency as they allow for further access to self-sovereignty, freedom of travel and, most importantly, access to becoming a global citizen.

“The pandemic and the current economic situation have created an increased demand for Citizenship by Investment Programs, with second citizenships offering a hedge against the recent and widespread political, economic turmoil, as well as the travel restrictions many have been subjected to over the last few years”— Nuri Katz, Founder and President of Apex Capital Partners comments on the topic.

What are cryptocurrency millionaires wish for?

One group in particular that we’re seeing a sharp uptick of applications for Residency and Citizenship by Investment Programs (RCBI) in other countries are cryptocurrency millionaires. Those who have made a fortune from cryptocurrency investments, as well as business professionals who strongly believe that crypto will positively impact their businesses in the future have contributed to the surge in inquiries for second passports. Favorable tax laws, opportunity cost, in addition to the growing amount of uncertainty in the field with regards to crypto legislation in the United States or elsewhere, are just a few of the reasons crypto millionaires are seeking second citizenships.

The blockchain concept is the answer

Cryptocurrency and blockchain are having a very significant impact in the investment immigration industry, having gained a tremendous amount of popularity during the height of the pandemic. The biggest question is, what makes cryptocurrency so attractive to these programs? The answer is the blockchain concept. Blockchains are best known for their crucial role in cryptocurrency systems, such as Bitcoin, for maintaining a secure and decentralized record of transactions. The innovation of blockchain is that it guarantees the fidelity and security of a record of data and generates trust without the need for a trusted third-party. In other words, cryptocurrency is decentralization and self-sovereignty.

Diversify your personal situation

Many people who have gained wealth through crypto currency, are diversifying part of their net worth into other hard assets such as real estate. They understand the volatility of the market and understand, obviously correctly considering today’s market, that they do need to look at including other asset classes in their portfolio outside of crypto currency. We have found that many of the Crypto crowd are understanding that they need not only diversify their finances, but their personal situation and therefore are looking at citizenship by investment programs around the world.

Investment migration programs perfectly compliment cryptocurrency as they allow for further access to self-sovereignty, freedom of travel and most importantly, access to becoming a global citizen.

Crypto Regulation and CIP Hot Spots

The regulatory environment surrounding cryptocurrencies varies from country to country with some banning the use of crypto to others that are advocates.

The obvious most appealing benefit of a second citizenship for crypto millionaires are the tax benefits. In late 2021, President Biden signed the Infrastructure and Investment and Jobs Act, which lays out new reporting requirements for certain crypto transactions and may pose serious implications for investors. For example, cryptocurrency brokers in the U.S. will be required to issue a 1099-like form disclosing who their customers are and businesses who except crypto will also be required to file a Form 8300 for every exchange they receive over $10,000.

Normally, crypto investors would have to convert their digital assets to fiat and place them in a traditional banking environment for the governments to approve funds and for it to be considered the source of wealth documents. What has been happening recently is that certain nations have been changing the laws and regulations regarding what can be included in the source of wealth documents for when opening bank accounts or even applying for citizenship.

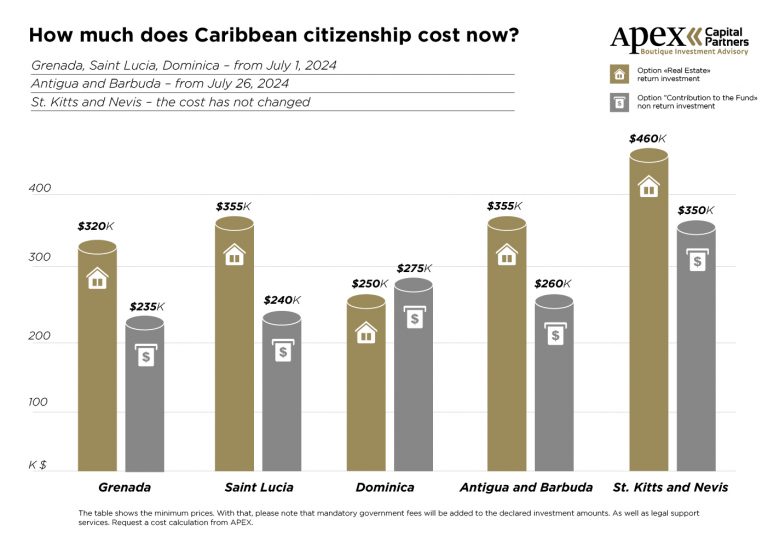

Second Citizenships: Portugal, Antigua & Barbuda, and St. Kitts & Nevis

Some of the most crypto-friendly RCBI jurisdictions are Portugal, Antigua & Barbuda, and St. Kitts & Nevis. Recently, Portugal closed its first Golden Visa linked real estate deal entirely in cryptocurrency. The government of Antigua and Barbuda passed legislation entitled the Digital Assets Business Bill of 2020, which officially became law on June 18, 2020. The Act governs, among other things, the claying on of a digital asset business in Antigua and Barbuda. St. Kitts and Nevis has welcomed digital assets with open arms, implementing legislation to make crypto transactions easier under its Virtual Asset Bill 2020. Additionally, St Kitts and Nevis has piloted its own digital currency known as DCash under the Eastern Caribbean Currency Union, further highlighting its crypto-friendly approach.

With these new regulations coming into effect and as we see more investors shift their money into cryptocurrency, we can certainly expect the crypto crowd to gravitate towards second citizenships where they will not only invest for citizenship but will continue to diversify and invest in hard assets.