Today’s world frightens investors with its unpredictability. This serves as a motivation for increasing interest in citizenship by investment programs. It would seem that the long-awaited completion of the covid pandemic should have been a start for the recovery of economies, but there is no stability even in the future, as well as growth. Also, there is a serious aggravation in society due to the disagreement of some segments of the population, including among entrepreneurs, with the policies, social programs and economies pursued by the authorities in many countries, including the United States.

Armand Tannous, the North and Latin American Vice President for Apex Capital Partners, the oldest and most-licensed boutique financial advisory firm specializing in advising international individuals and governments on citizenship by investment (CIP), gives answers to the most asked questions due to the growing demand on participating in CIP’s.

❓About himself and his role in the industry

Tannous: I was a wealth management advisor working for a top financial institution in Canada focused, primarily, on high and ultra-high net worth clients. Prior, I was introduced to CIP — investment migration — in 1989. My family decided to move to Canada, from Syria, under the Immigrant Investor Program, which is similar to programs in the U.S., Portugal, and Malta.

This process intrigued me from a young age and, eventually, I joined forces with Apex Capital Partners as their Vice President. There, I lead the North and Latin American offices where I educate the markets in regards to what citizenship and residency by investment are.

❓Is business booming

Tannous: A serious surge in interest over the past few years. Definitely. For one, there’s been an increase in wealth, with markets rising. Additionally, individuals are looking to have another plan in case they renounce their citizenship.

❓What is important to know about services and expertise of Apex Capital Partners

Tannous: We help private clients create or find the solution to their citizenship and residency needs. I call it citizenship and residency planning. We also are very big in government advisory, helping governments create, maintain, and operate citizenship by investment programs. We’ve done some work, most recently, with Montenegro and Anguilla. They have a strategy and now know how to market the program, especially to wealthy foreigners.

❓What’s the benefit of having another citizenship

Tannous: You can get access to different asset classes and business opportunities, as well as protection of net worth.

❓What’s a barrier to entry for CIPs

Tannous: Having enough investable assets — two to three million — makes this a strategic play and is normally what we deal with. The other barrier is knowledge, and this is why we are focused on education and planning.

❓What’s the difference between Apex and other solutions in the space

Tannous: We take pride in working with the countries in which we are government-mandated to raise foreign investment and represent the client to the government. You never deal with the government directly. You deal through me.

❓What’s the most sought-after residency for high-net-worth individuals

Tannous: If they’re from emerging nations — the Middle East, Russia, Asia — they’ll typically look at countries like the U.S. and Canada. The issue with those two is the physical residency requirements. So, a lot of our clients have been looking into programs like Montenegro because it’s not in the European Union (EU), right now. But, in 2025, they’re joining the EU. So, basically, you’re getting an EU passport at a discount because the investment barrier is much less than it is in the EU.

❓What are some other lucrative residency programs

Tannous: Portugal is also very incredible because of its Golden Visa Program. You don’t need to be in Portugal for six months to be considered a resident. Instead, you only have to be here for seven days of the year. You have to make an investment, ranging between 350,000 and 500,000 euros. These investments can be in real estate or public markets. In regards to tax planning, you have the Non-Habitual Resident (NHR) Portugal program which allows a resident, for the next ten years, to pay zero in taxes on his personal global income, capital gains, and dividend income.

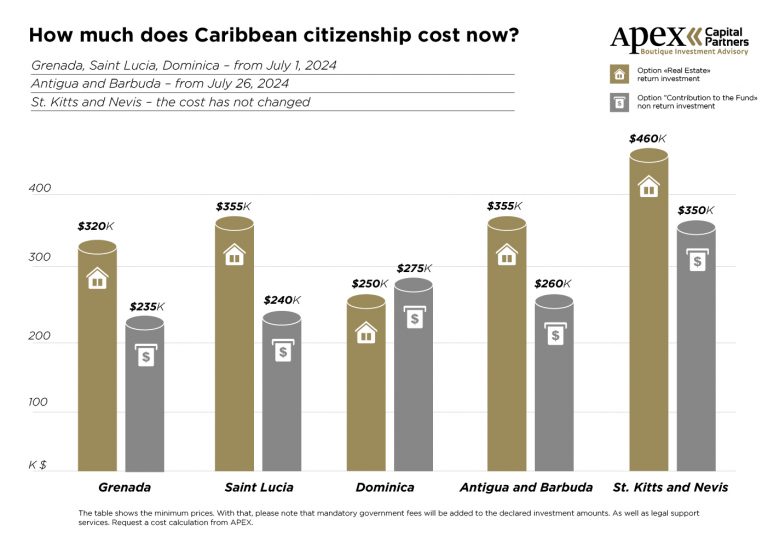

There are programs like Saint Kitts, in the Caribbean. In three months, you get citizenship and you may travel visa-free to 156 countries, including the U.K. for six months of the year, or the EU for three months of the year.

❓Are there any misconceptions or things individuals fail to think about

Tannous: Leaving the U.S. and thinking you do not have to declare anything to the U.S. tax authorities anymore. You still have responsibilities to the U.S. tax authorities because you’re a U.S. citizen. If you get a second citizenship, you have to be able to tax plan and know what you can declare. Also, many people lie about their physical residence. Do you think people moving to Puerto Rico are living there for six months of the year? There are ways to check for that and, in the next five or ten years, there is going to be a lot of investigation and auditing.

https://www.facebook.com/watch/ApexCapitalPartnersCorp/

❓Does it cost anything to work with Apex

Tannous: It does. We set up the applications, collect the documents, and continuously liaise with the governments. Then, we also help with bank accounts, real estate, and lawyers.