In these turbulent times, many top business executives and other high-net-worth individuals (HNWIs) are exploring paths to dual citizenship around the world. If you have roots to the dual citizenship in your family, you may request citizenship of Israel. Or even citizenship of European country like Tom Hanks and wife Rita Wilson became Greek citizens in 2020. Or like New Jersey native Kirsten Dunst acquired German citizenship in 2011, thanks to her German father. Why do the Hollywood stars need a dual citizenship? Because even they need work visas to film in Europe—unless they carry an E.U. passport. Or imagine a new lock down. Where do you want to spend time – for sure in a mild climate.

Today, almost 30 countries offer some form of CRBI program (although some governments also require a minimum number of days of physical presence per year). Toronto-based Apex Capital Partners’ vice president, Armand Tannous, has seen a 200-percent rise in CRBI applications from U.S. citizens since early 2020.

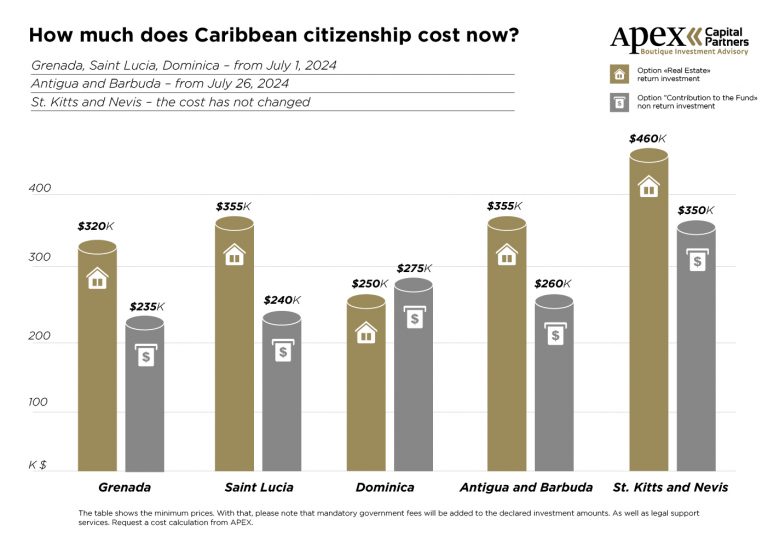

Since residency and citizenship via investment costs a lot more than tracking down Grandpa’s birth certificate, CRBI is very much the purview of HNWIs. This acronym has no legal definition, but finance professionals generally define HNWIs as those who hold between $1 million and $5 million purely in liquid assets. That is, money or value held in bank or brokerage accounts—but not locked-in assets such as a primary residence, long-term investments, art collections or durable goods.

Dual citizenship — hedge against geopolitical risk and lockdowns

During the E.U.’s travel ban in summer 2020, many Americans found themselves locked down, but those with an E.U. passport still had visa-free access to over 150 countries, and that highlighted the benefits of secondary citizenship. Smart money is always planning for worst-case scenarios and people want a plan B, which is why applications have soared in the last 18 months. And while for most of us a $200,000 investment is a significant sum, for HNWIs it’s simply a way of diversifying their portfolio. So rather than buy a condo in South Beach, for example, they can invest in a Caribbean property and get residency or citizenship, too.

Most of investors are not relocating but want alternative citizenship to avoid being restricted to a single jurisdiction, in the event they want or need to settle elsewhere.

Nuri Katz, founder and CEO of Apex Capital Partners, says his team has seen “a sharp uptick in CRBI applications from young cryptocurrency millionaires.” Many Americans and U.S. residents made a fortune from crypto investments, he says, but are worried about the specter of increased legislation and regulation, and are now looking at relocating to more crypto-friendly nations, such as St. Kitts and Nevis — which recently passed legislation to make crypto transactions easier and piloted its own digital currency known as DCash, a digital version of the Eastern Caribbean dollar. Crypto moguls are also increasingly focused on El Salvador, which plans to implement a CRBI program and has no capital-gains tax on digital assets like cryptocurrencies.

Read our article about options of St.Kitts and Nevis’s CIP >>