In one of the boldest immigration proposals in recent memory, the Trump administration has unveiled the “Trump Gold Card”—a US$5 million investor residency program aimed squarely at the global elite. Promising a fast track to U.S. legal residency through a high-value investment, the initiative is already attracting massive interest from entrepreneurs, executives, and high-net-worth individuals seeking a premium gateway into the world’s largest economy.

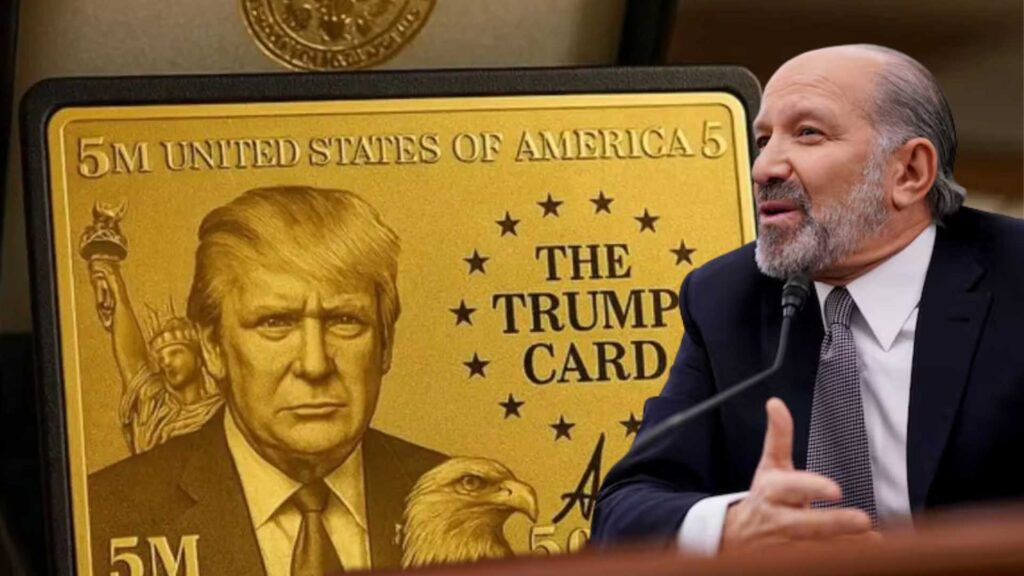

Within days of its launch, nearly 70,000 registrants had signed up to express interest, with the number climbing by the hour. According to Commerce Secretary Howard Lutnick, who has become an unexpected evangelist for the initiative, over 1,000 sign-ups occurred in a single 60-minute window on June 17. The registration site—TrumpCard.gov—showcases a gleaming gold design featuring Trump’s likeness, an eagle, the Statue of Liberty, and the American flag, underscoring the administration’s intention to make this a luxury-tier product both visually and politically.

For investors and advisors alike—including firms like Apex Capital Partners, which specialize in guiding global citizens through high-stakes residency and citizenship programs—this announcement marks a major development in the investment migration landscape.

A $5 Million Investment Into the American Dream

The Trump Gold Card is more than a branding exercise—it represents a pivot in how the U.S. is thinking about investor immigration. While the EB-5 visa program has long offered green cards in exchange for economic investment (with a significantly lower price tag), the Trump Card proposes a streamlined and dramatically upscale alternative. Lutnick has hinted that the program could either replace or run parallel to EB-5, though final determinations are still in flux.

What’s clear is the target market: wealthy foreign nationals, particularly those with entrepreneurial, scientific, or executive backgrounds. Lutnick said the initiative was designed to court “the world’s best and brightest,” and has already been pitched to corporate leaders from top tech firms, some of whom are reportedly exploring the purchase of Gold Cards in bulk for executives.

From Concept to Controversy: The Trump Card’s Unfolding Narrative

The idea reportedly originated with billionaire Trump ally John Paulson as a solution to address the U.S. government’s ballooning $36 trillion debt. The math, at least in theory, adds up: if 200,000 Trump Cards are issued at $5 million each, that’s a $1 trillion windfall for the Treasury.

That ambition—paired with a sleek marketing rollout—has lent the program an air of Silicon Valley-meets-State Department. Elon Musk confirmed his involvement in developing the digital infrastructure behind the card, noting that it had already entered a “quiet trial” phase prior to public launch. Tech-forward or not, the rollout has left key questions unanswered. Critical elements such as tax treatment for cardholders, application vetting criteria, and country-based exclusions have yet to be finalized by the Departments of Homeland Security and State.

Selling America—One Card at a Time

Perhaps the most unconventional aspect of the Trump Gold Card’s rollout has been its chief spokesperson: Commerce Secretary Howard Lutnick. Far from the usual policy wonk role, Lutnick has embraced a more unorthodox approach, proudly admitting on the All-In podcast that he “sold a thousand” cards in a single day. On international trips—including visits to the UAE, Saudi Arabia, and Qatar—Lutnick reportedly closes meetings with foreign dignitaries by pitching the Gold Card.

His enthusiasm isn’t just rhetorical. “Whenever I meet with international executives, I always go through it with them and sell it to them,” Lutnick said recently, before laughing, “I can’t help myself.”

Critics argue that this commercialized tone trivializes immigration policy. Supporters counter that the model offers a pragmatic way to attract capital, innovation, and entrepreneurial talent to American soil. Either way, the strategy marks a shift: immigration as premium product, not just policy.

A Magnet for High-Net-Worth Migration

The timing of the Trump Card rollout taps into a global trend: record levels of wealth migration. With millions of millionaires projected to relocate in the coming years—often driven by political instability, taxation, and lifestyle preferences—the U.S. is making a bid to remain a top-tier destination for capital and talent.

This positions the Trump Gold Card as a potential competitor to investor visa programs across Europe, the Caribbean, and Asia, many of which are tightening requirements or facing political scrutiny. For international advisors like Apex Capital Partners, known for working directly with investors seeking alternative citizenship and residency options, the Gold Card represents a new pillar of the U.S. investment migration framework—if it moves from concept to law.

Key Unknowns: Eligibility, Processing, and Delivery

Despite strong interest, many aspects of the Trump Gold Card remain speculative. The White House has not clarified whether certain nationalities will be barred from participation—an especially relevant concern given Trump’s history of imposing travel bans on citizens from over a dozen countries.

Similarly, while Lutnick promises that the card will be made of actual gold and aesthetically striking, the process for obtaining one—application vetting, security screening, background checks—remains under development. With multiple federal agencies involved, from the Commerce Department to Homeland Security, the implementation timeline could stretch well beyond summer.

There is also ambiguity about what exactly cardholders receive beyond legal residency. Will it include fast-track green card pathways? Will dependents be covered? Will there be tax exemptions or other economic incentives? For a $5 million price tag, investors will expect more than just a shiny card and legal status.

The Investment Migration Sector Watches Closely

Firms operating in the investment migration space are already fielding client questions. At Apex Capital Partners, a firm recognized for its discreet handling of high-value migration strategies, early signals suggest interest is surging, even in the absence of concrete program mechanics.

The firm cautions that while the registration portal is live, investors should tread carefully. “Until there’s clarity on the legal framework, processing times, and security review criteria, serious investors should treat this as a concept—not a guaranteed path,” one advisor notes. That said, many view the rollout as a bellwether of where U.S. policy is heading: more selective, more expensive, and more prestige-focused.

Trump, Branding, and the Politics of Exclusivity

At its core, the Trump Gold Card is also an exercise in brand positioning. From the card’s metallic sheen to its promise of exclusivity, the program blends immigration with luxury appeal—something rarely seen in U.S. policy circles.

Trump, never one to downplay optics, reportedly insisted that the card must “feel good” in hand and look “beautiful,” according to Lutnick. This aesthetic focus underscores the administration’s goal to reframe immigration not as a bureaucratic process, but as an elite offering for those who can afford it.

It’s a branding play that mirrors trends in real estate, finance, and even crypto—where access, scarcity, and exclusivity drive value. Whether this turns into a viable policy or simply another political headline, the message is clear: U.S. residency is being marketed as a luxury product for the global rich.

Is the Trump Gold Card the Future of American Immigration?

While the Trump Gold Card has yet to reach full legislative implementation, it signals a broader shift in how the U.S. might structure investor immigration moving forward. By setting the bar high—both in terms of capital and perceived prestige—the initiative could attract serious players while discouraging lower-tier applications that have historically strained immigration systems.

Yet this approach also risks reinforcing a two-tiered immigration system—one for billionaires, another for everyone else. For proponents, the economic impact justifies the model. For critics, the optics are concerning. Either way, the card is now in play, and with nearly 70,000 registrants and growing, the stakes are real.

As investors worldwide wait for further announcements, advisors like Apex Capital Partners are preparing clients for what could become the most talked-about investor visa in U.S. history. Whether it lives up to the hype—or collapses under political pressure—remains to be seen.