How to actually obtain Paraguay citizenship—and how to avoid being scammed

Paraguay has long attracted the attention of foreign investors and expats thanks to its lenient tax system and relatively simple path to permanent residency. Consequently, cases of Paraguay citizenship fraud have recently become more common. We discuss fake offers and counterfeit passports in Paraguay. However, there are official paths to permanent residency and citizenship in Paraguay.

How to Use Crypto to Invest in Second Citizenship: Where Bitcoin and Second Passports Converge

Crypto citizenship in 2025 gives investors the ability to convert Bitcoin wealth into global mobility, tax advantages, and stronger passports. El Salvador leads with Bitcoin-based residency, Vanuatu offers unmatched speed, the Caribbean simplifies family applications, and Portugal integrates blockchain funds. Apex Capital Partners guides crypto investors through every program to achieve global freedom.

Citizenship For Retirement: The Best Countries to Retire from the US

Retiring abroad requires careful planning, especially when securing the right second passport. In 2025, Caribbean CBI programs and Portugal’s residency option provide the strongest pathways for US retirees seeking freedom, tax benefits, and lifestyle upgrades. Apex Capital Partners breaks down the best choices to match your goals.

American Second Citizenship Demand Is Shifting From Europe to Emerging Markets

Wealthy Americans are rushing toward Latin America and Asia in search of second passports, shifting away from Europe’s once-popular programs. Rising costs, stricter rules, and limited options in Europe have driven U.S. citizens toward faster, more affordable routes in Costa Rica, Panama, Uruguay, Thailand, and Malaysia. These programs offer relocation opportunities, lower investment thresholds, and stronger lifestyle benefits. The surge reflects a broader wealth planning trend where American second citizenship is no longer a luxury but a necessary tool for security and mobility.

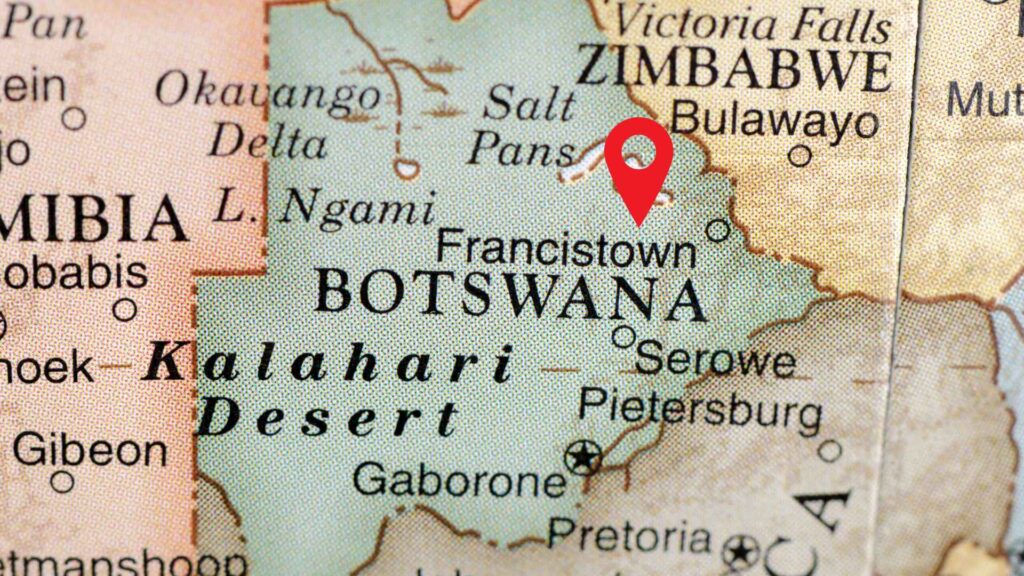

Botswana Citizenship by Investment to Become World’s Cheapest Passport Option in 2026

Botswana will launch its Citizenship by Investment Program in early 2026, offering contributions between $75,000 and $90,000. Positioned as the most affordable globally available program, it aims to diversify the nation’s economy beyond diamonds while attracting investors seeking new opportunities in Africa. Limited quotas and early registration make this program a unique chance for global citizens to secure an African passport.

Caribbean Sets New Integrity and Sustainability Standards for Citizenship By Investment Programs

The OECS has introduced sweeping reforms to Citizenship by Investment programmes, establishing a regional regulator, stricter due diligence, and a $200,000 minimum threshold. These changes safeguard integrity and sustainability while ensuring CBI remains a vital development tool for Caribbean economies. For investors, the updates deliver stability, transparency, and stronger global recognition.

Dual Citizenship is The Modern Strategy for True American Freedom

American dual citizenship is no longer a luxury but a core strategy for investors in 2025. From Caribbean citizenship by investment to European residency programs, Americans are securing second passports for diversification, security, and long-term planning. Apex Capital Partners guides clients through every step with licensed expertise.

How Nauru Is Turning Citizenship Investment into Climate Capital

Nauru, the Pacific’s third-smallest nation, has launched a unique Citizenship by Investment program that converts investor capital into climate action. With respectable visa-free access and a climate-driven mission, the program offers high-net-worth individuals the chance to secure a second passport while supporting vital resilience projects. This model signals a new era of purpose-driven citizenship.

Top CBI Programs of 2025: Where Smart Investors Are Planting Flags

In 2025, the global CBI landscape has narrowed and matured. With Malta out, only top-performing programs remain—each with unique advantages for strategic investors. This guide compares the best options based on investment threshold, processing speed, and investor-focused reforms.

Investment citizenship or residence permit: how to renew documents after receiving them?

Let’s consider three key areas, the specifics of extending and reissuing documents. Residence permit in Greece for investment, investment citizenship of Caribbean countries, investment citizenship of Vanuatu.

Why are we touching on this important topic? APEX receives many questions about how to renew a coveted document after receiving it – a plastic card with a residence permit or a passport – when it expires. Those who applied through another company also contact APEX. Because APEX stays with clients even after they receive second citizenship offering after-sales service.

St. Kitts & Nevis Citizenship By Investment Program Expands Dependent Criteria

St. Kitts and Nevis has expanded its Citizenship by Investment program by raising the dependent age limit to 30 and removing the full-time education requirement. Families can now include more adult children under one application, making the program more flexible, cost-effective, and competitive with other Caribbean CBI programs.

Argentina Citizenship by Investment: How Does the Program Work?

In the spring of 2025, Argentina’s President Javier Milei, a passionate admirer of Donald Trump’s economic decisions, announced the development of an Argentina citizenship program. All industry experts immediately began to weigh the prospects and possibilities of launching such a product. It should be noted that the Argentine passport gives the right to visa-free entry to many countries of the world, including Europe (Schengen zone). Argentina is also in the process of rebooting its relations with the United States – on July 29, 2025, an application was submitted to rejoin the US Visa Waiver Program. With an Argentine passport you can live in 9 countries of South America (Mercosur). So, the advantages of Argentine citizenship are obvious, but what are the conditions?